Whenever you apply for a loan or credit card, the lender will likely pull your credit report and get your credit score.

Your credit score is a number between 350 and 800 that sums up your creditworthiness according to factors like paying your bills on time and how much money you’ve already borrowed.

There are three credit-reporting agencies, Equifax, Experian, and Transunion that calculate credit scores. They all use the same software to analyze your credit history and come up with a credit score. But scores may still be a little different based on how each credit bureau sets up the software and if your creditors report the same information to each agency.

If your score is a lot higher on one report than the other two, it is likely that one of your creditors is not reporting to that bureau.

The FICO is considered the standard credit score and is used by 9 out of 10 lenders. The score is named after the company, Fair Isaacs and Company that created the software and credit scoring process. Over the years, the name of the company was shortened to FICO.

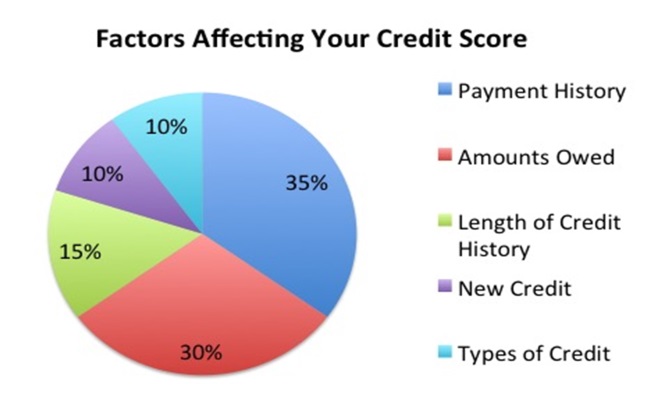

The FICO score is made up of five factors that together determine your credit score. Not all affect it equally, so here is a breakdown of the most and least important factors.

This measures your past ability to pay your bills on time. It has the biggest impact on your score, accounting for 35 percent of your total score. Not every bill you pay late shows up on your credit report. Typically, utility, cable, mobile phone and medical bills don’t show up until they go into collections. But, credit card, auto loans, home mortgages and other personal loans report after you fall 30 days behind.

The amount of money you owe on loans and credit cards is the next biggest factor, accounting for 30 percent of your score. This basically comes down to what’s called credit utilization. This has to do with the amount of money you have available to borrow and the amount you have actually paid back.

For example, if you had a credit card with $1,000 of available credit and a car loan for $9,000 and you have paid back $500 on the credit card and $4,500 on your car loan, you’re using $5,000 of the $10,000. That means your credit utilization is 50 percent.

This is ok, but to raise your credit score to its highest level it’s best to use 25 percent or less of your available credit. That doesn’t mean you can’t use more of you credit, but you have to have it paid down to that level when credit-reporting agencies review your credit history each month.

The age of your loans (or how long you have been borrowing money) makes up 15 percent of your score. Usually a longer credit history is better than a shorter one. Why? It gives a more accurate picture of how you’re likely to handle new credit.

What type of credit do you have now? You can carry various types, credit card debt, installment loans (for example, an auto loan that is paid back with monthly installments for a set period of time), home or mortgage loans, or even store credit cards from places like Target or Belk. Your mix of credit types accounts for 10 percent of your score.

Did you know that getting several loans or credit cards in a short period of time brings your credit score down? It can and that’s why it’s important to plan ahead if you need to borrow money. You don’t want to open a small account right before you are getting a loan for a car or house.

Why? You want your score to be at its highest level so you can get the lowest interest rate if you get a loan on these big-ticket items. This factor accounts for 10 percent of your score.

These general guidelines show how a credit report is scored for a wide-range of consumers, but your specific credit profile can make some factors more important than others when a lender looks at your score. But one thing is obvious paying your bills on time and your credit utilization are the two most important factors to focus on when trying to raise your credit score.